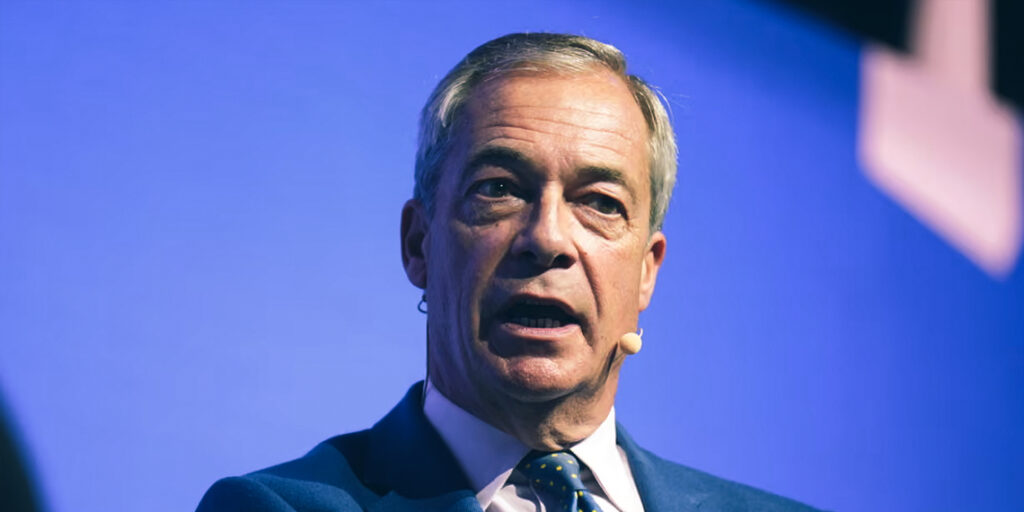

Nigel Farage has hinted that he would seek to reshape the Bank of England’s leadership and oversight if he were to become prime minister, suggesting he might replace the current governor, Andrew Bailey.

“He’s had a good run, we might find someone new,” Farage told Bloomberg’s The Mishal Husain Show, before adding that Bailey was “a nice enough bloke”.

While Farage’s influence over the central bank remains hypothetical, his comments signal his desire for politicians to play a greater role in the Bank’s decision-making. Bailey’s single eight-year term runs until March 2028, meaning that any change would likely depend on the outcome of the next general election, due before August 2029.

The Reform UK leader’s stance mirrors that of his ally, former US president Donald Trump, who repeatedly clashed with the US Federal Reserve during his time in office. Trump demanded lower interest rates, publicly criticised the Fed’s chair Jerome Powell, and sought to expand his administration’s control over the independent institution.

Farage has made similar calls in Britain, arguing that the Bank of England should face greater political oversight. His latest remarks come shortly after he and Reform MP Richard Tice met with Bailey at the Bank’s headquarters on Threadneedle Street. The meeting followed a series of letters between the two sides, in which Farage pressed for an end to bond sales and a reduction in the interest rate paid to UK banks.

Tice has previously argued that the Treasury should be permitted to appoint “one or two” government representatives to the Bank’s Monetary Policy Committee, the body responsible for setting interest rates.

Farage, a former commodities trader and now a brand ambassador for a gold investment company, has also expressed ambitions to turn London into a global “powerhouse” for cryptocurrencies. He has criticised Bailey in the past for being a “dinosaur” on digital currencies but said he was encouraged by the governor’s more recent openness toward stablecoins, a form of cryptocurrency designed to maintain a fixed value.

“The Bank of England, the British government, the regulator – whatever shape that takes – they’ve all got to understand the world is changing, has changed, very, very rapidly,” Farage said.

A Bank of England spokesperson later confirmed that Bailey had “a productive meeting” with Farage and Tice.