28 June 2025 marks 20 years since the Glazer family completed their controversial takeover of Manchester United Football Club, a move that has had lasting financial and sporting consequences.

The Glazers, an American family based in Florida, acquired the club for £790 million in June 2005, removing it from the London Stock Exchange.

However, the deal was largely funded through debt—£604 million was borrowed from hedge funds and placed directly onto the club, which had previously carried just £50 million in liabilities.

£1.2 Billion Drained from Club Finances Since 2005

According to BBC Verify, Manchester United has spent an estimated £1.2 billion over the past two decades on debt repayments, interest, dividends, and Glazer family fees.

In just the first year after the takeover, £53.2 million was paid in interest and fees.

The total figure excludes additional hidden costs, such as bank charges, financial advisory fees, and currency hedging.

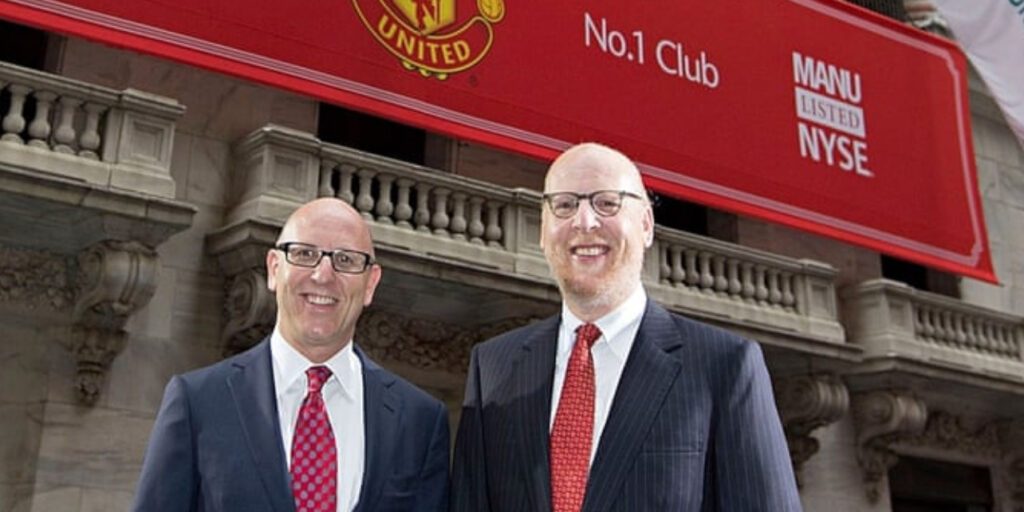

It also omits directors’ remuneration—since re-listing shares on the New York Stock Exchange in 2012, United has paid out £125 million to directors, around half of which is believed to have gone to Glazer family members.

A Takeover Widely Opposed by Fans and Warned Against by the Club

Before the deal was finalised, Manchester United’s board raised strong concerns in April 2005, stating that the high level of debt was “not prudent” and risked a “downward spiral” in both performance and finances.

Supporters have voiced opposition ever since, staging numerous protests over the years.

Have the Glazers Added Financial Value to Manchester United?

Despite criticism, the Glazers point to a significant increase in Manchester United’s commercial success.

Between 2006 and 2024, the club’s commercial revenue grew from £55 million to £303 million. The market value of the club has also risen—from £790 million at the time of purchase to a valuation of over £4.3 billion, according to the 2024 minority stake sale to Sir Jim Ratcliffe.

In terms of player investment, United has spent over £2 billion on new signings since 2012, a figure that compares competitively with other elite clubs.

On-Pitch Decline Post-Ferguson

However, since Sir Alex Ferguson’s retirement in 2013, on-pitch success has waned. While United have won 15 major trophies under Glazer ownership, only five have come in the post-Ferguson era.

The 2023/24 season saw the club finish 15th in the Premier League—its lowest position since 1974–75.

CEO Omar Berrada admitted the season fell “below our standards”, and promised renewed focus for improvement.

How Much Have the Glazers Personally Invested?

While the Glazers used £273 million of their own capital during the 2005 acquisition, no further personal investment has been made since.

The club’s operations—including transfers and infrastructure—have been funded through internal cash flows and further debt.

Between 2012 and 2022, the family sold £555 million worth of shares, pocketing £484 million for themselves, with only £71 million going towards the club’s debt.

Manchester United’s Debt Situation Today

The club’s gross debt peaked at £604 million in 2006 and stood at £547 million in 2024. Broader debt metrics, including future transfer payments, bring this figure closer to £1 billion. Average annual interest payments since 2005 have been £42 million, including £37.2 million in the 2023/24 season alone.

Sir Jim Ratcliffe’s Recent Investment: A Turning Point

In 2024, Sir Jim Ratcliffe purchased a 30% stake in Manchester United for £732 million, taking control of football operations.

Unlike previous deals, Ratcliffe injected an additional £236 million directly into the club, earmarked for upgrading Old Trafford. Crucially, this investment was not debt-financed.

Ratcliffe revealed in a BBC interview in March 2025 that the club had been on the brink of running out of money, prompting urgent cost-cutting and financial restructuring.