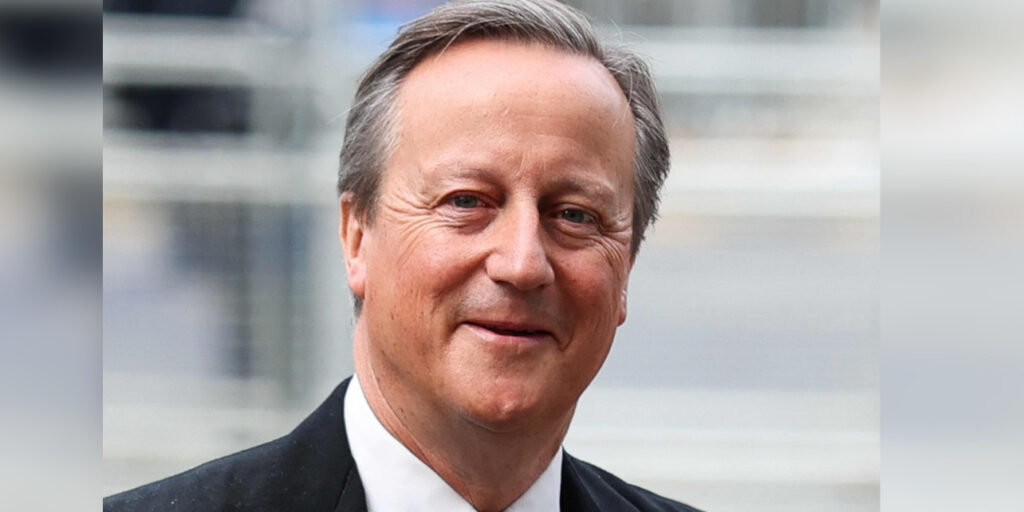

David Cameron is reportedly in talks to join London-based law firm DLA Piper as a consultant, focusing on advising the firm on geopolitical risks.

This development comes five years after the Greensill scandal, where Cameron faced criticism for lobbying government officials on behalf of his former employer.

The former prime minister, who also served as foreign secretary last year, is expected to take on the advisory role alongside his current positions. His register of interests shows he is already an adviser to private equity firm Finback Investment Partners and hedge fund Caxton Associates. Additionally, he chairs the advisory board of payment solutions company PayCargo LLP.

Reports suggest Cameron’s role at DLA Piper, the world’s third largest law firm, will not involve lobbying on their behalf. Since stepping down as prime minister in 2016, Cameron has held several roles, including lobbying for Greensill Capital, which collapsed amid controversy.

A 2021 Treasury committee inquiry found Cameron sent 62 messages to former government colleagues requesting assistance for Greensill. The inquiry concluded this showed a significant lack of judgement, especially as Cameron held stock options in the firm worth potentially tens of millions.

Cameron has also worked with the gene sequencing firm Illumina, which secured a £123 million government contract during the pandemic, and was involved with AI company Afiniti before stepping down in 2021. Prior to his foreign secretary role, he was linked to efforts promoting a port project in Sri Lanka connected to China’s Belt and Road Initiative.

Both Cameron’s office and DLA Piper have declined further comment on the talks, though DLA Piper confirmed discussions are ongoing.

Separately, Cameron has reportedly faced difficulties obtaining a Vodafone mobile contract for one of his children, with speculation this was due to his status as a politically exposed person (PEP). This classification, aimed at preventing bribery and corruption, has increasingly caused banks and financial institutions to restrict services for politicians.

This issue gained attention after Nigel Farage, Reform UK leader, had his Coutts bank account closed due to similar reasons. Farage has criticised the treatment of PEPs, highlighting the unfair impact on families.

The Financial Conduct Authority issued guidance last year, urging banks to ensure politicians and their families are treated fairly and not unjustly denied financial services.