The UK gas storage crisis could worsen significantly if Centrica shuts down the Rough storage facility, the country’s largest natural gas storage site. Without government support, the company has warned the site will be decommissioned, slashing the UK’s already limited energy buffer.

Centrica, the owner of British Gas, revealed it halted injections of gas into the Rough facility last month, citing financial unsustainability. Despite ongoing talks with the Government, CEO Chris O’Shea said the facility may be shut down permanently unless the Government helps unlock £2 billion in investment needed to modernise the site.

Centrica Urges Government to Unlock Investment, Not Provide Funding

Speaking to the BBC, O’Shea clarified that Centrica is not seeking direct financial aid but rather a regulatory environment that encourages private sector investment. He estimated that Rough would lose £100 million this year due to operating costs alone and noted that revamping the site without market incentives would result in a significant financial loss.

“What we’re asking for is simply for the Government to help create the conditions which will unlock £2 billion of investment,” said O’Shea, adding the upgrade would secure thousands of jobs during construction and safeguard skilled positions.

Rough Facility Critical to UK Energy Resilience

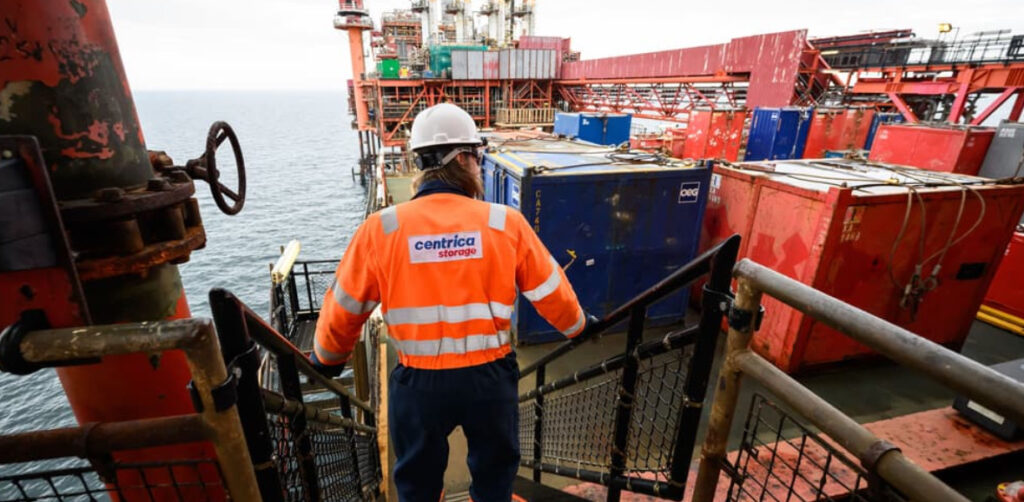

The Rough facility, located off the coast of Yorkshire in the North Sea, currently accounts for nearly half of the UK’s total gas storage capacity. It acts as a vital buffer during cold weather spikes in demand, yet the UK’s gas storage capacity lags far behind that of other European nations.

Without Rough, the UK’s gas storage would fall from 12 days to just six, compared to over 100 days in countries like Germany and France.

Centrica also suggested the site could transition to the world’s largest hydrogen storage hub, a move aligned with the country’s clean energy ambitions.

Government Calls It a Commercial Decision, Critics Warn of Risk

The Department for Energy Security and Net Zero stated that the “future of Rough is a commercial decision for Centrica,” but added it remains open to discussing proposals if they offer value for taxpayers.

Meanwhile, the closure threat has renewed concerns over the UK’s energy resilience and readiness for future supply disruptions. O’Shea warned, “We’ll lose this resilience,” if the site is decommissioned.

Executive Pay Row Amid Rising Energy Costs

Centrica has also come under scrutiny for its executive pay. At its latest AGM, nearly 40% of shareholders opposed CEO Chris O’Shea’s compensation package. He received £4.3 million in total pay last year, including a 29% increase in base salary to £1.1 million.

Pressed on this during a cost-of-living crisis, O’Shea acknowledged public frustration but said, “I don’t set my own pay,” and emphasized the need for an energy system that is “clean, resilient, and affordable.”

Clean Energy Transition Must Remain Affordable

O’Shea warned that if the UK creates a clean energy system “where people can’t afford to pay their bills,” the transition will be deemed a failure. He urged a fact-based approach over political soundbites and said the shift to cleaner energy offers a major economic opportunity—if managed correctly.

The Department reiterated its commitment to clean power by 2030 and said that modernising the energy system could ultimately lead to lower costs for consumers.