Inflation in the UK is projected to increase in early 2025, with January seeing a sharp rise to 3.1% before stabilising in the spring.

Using data from January 1999 to December 2024, the latest forecast relies on a simplified Machine Learning-based Recurrent Neural Network (MRN) model, trained solely on Consumer Price Index (CPI) data.

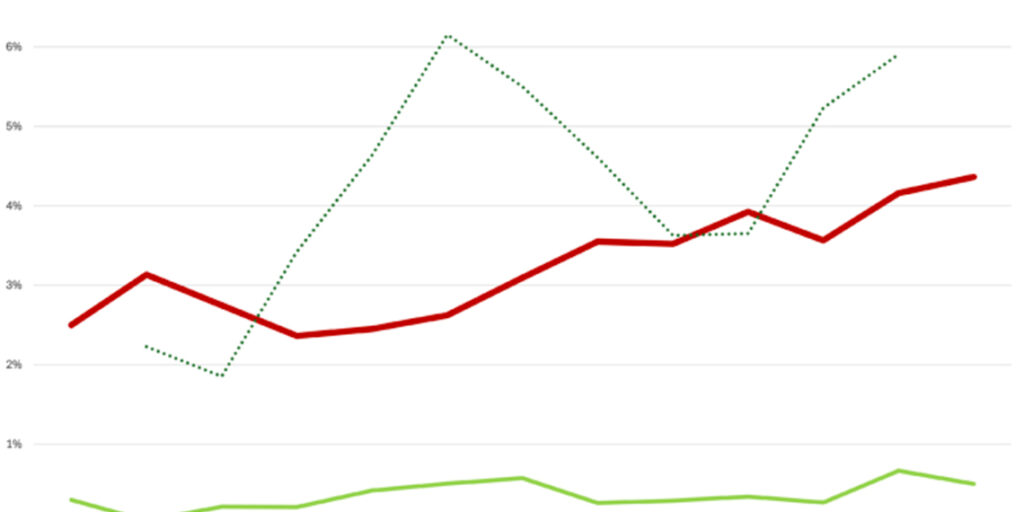

The forecast predicts that headline inflation, which ended December 2024 at 2.5%, will jump to 3.1% in January 2025.

This rise is largely due to the removal of a major price drop recorded between December 2023 and January 2024, which significantly lowered inflation figures at the time.

The January inflation increase is expected to be followed by a decline to 2.3% in March 2025, before inflation climbs above 3% again from June onwards.

One of the main contributors to the inflation hike is the scheduled OFGEM energy price cap adjustments.

The confirmed January 2025 increase alone has added 0.05 percentage points to inflation, while the anticipated April rise is projected to contribute an additional 0.11 percentage points.

The forecast model suggests that inflation may continue to rise beyond mid-2025, though long-term predictions should be approached with caution. Historically, inflation has followed a pattern where, once it exceeds a certain level, it tends to climb even higher. This has been observed during periods such as the Global Financial Crisis (GFC) and the recent cost of living crisis.

The Simple MRN model used in this forecast has performed as accurately as more advanced MRNs over short-term periods. Statistical evaluations, including the Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), Symmetrical Mean Absolute Percentage Error (SMAPE), and Theil’s U, show that this model offers strong predictive accuracy for inflation up to three months ahead.

Beyond that period, external factors and economic changes may cause greater volatility in inflation trends.

The UK’s inflation trajectory remains uncertain, but early 2025 is expected to bring a temporary inflation surge, followed by a period of relative stability before another potential increase in the summer months.

Policymakers and businesses should monitor economic indicators closely, particularly in relation to energy prices, consumer demand, and wage growth, which will all play a role in shaping the UK’s inflation landscape in the year ahead.